Why do Rolex Prices Increase? [Complete Guide]

If you have kept track of the prices of Rolex watches, both from Rolex official retailers, I.e the recommended retail price, and the prices on the secondhand market, you have likely seen that the prices increase over time.

But why is it that Rolex prices increase? That’s what we’ll get to the bottom of in this article. And to do so, we need to look at both the recommended retail prices and the prices on the secondhand market.

Recommended retail price vs market price

When talking about the price of Rolex watches, we need to separate the recommended retail price and the market price. Whilst these two have a great relation and correlation, they’re not strictly dependent on each other.

The recommended retail price is the price that Rolex sets for its watches and that they expect their official Rolex retailers to sell the brand new watches for. Here, Rolex decides the prices and the recommended retail prices are not always directly set and adjusted according to the market values of their timepieces.

The market prices, on the other hand, are decided by the market and are something that Rolex has limited control over. And we say limited because the fact is that what Rolex does has a great effect on the secondhand market, but to a great extent, it’s not about the recommended retail prices, but rather about the supply of certain watches.

The market price is simply the amount of money that the market is willing to pay for any given watch. The market prices are determined by supply and demand. Reduce the supply whilst maintaining a high demand and you have increased prices on the secondhand market. Increase the supply and you have declining prices on the secondhand market.

Recommended retail prices correlation with secondhand market prices

In the last decade and the last couple of years, in particular, the prices for Rolex watches on the secondhand market have increased dramatically. The reason for this is the growing demand for Rolex watches and the relatively limited production numbers. Whilst Rolex makes approximately 1 million watches per year, the total production number isn’t really relevant. What is more relevant is how great the demand is, and whether this is lower or higher than the total production.

And what we can say in the last couple of years is that the demand is far greater than the demand. Many Rolex watches are nearly impossible to get from official Rolex retailers at the recommended retail price and many models have long waiting lists. When scarcity grows and the demand remains high, people turn to the secondhand market to buy them. And this ultimately drives up the prices. And when prolonged periods of high demand and low supply take place, we have ever-increasing Rolex prices on the secondhand market. This is exactly what has happened in the last couple of years. For some models, the market prices are several times higher than the recommended retail price.

Now, reasonably, Rolex could increase the recommended retail prices to the same as the market prices because technically, that is what the market deems them to be worth. From a business standpoint, it doesn’t make any sense for neither Rolex nor the official retailers to sell the watches for less than what it’s worth. But that has become the case when the scarcity of Rolex watches has grown so immensely due to a dramatic increase in demand.

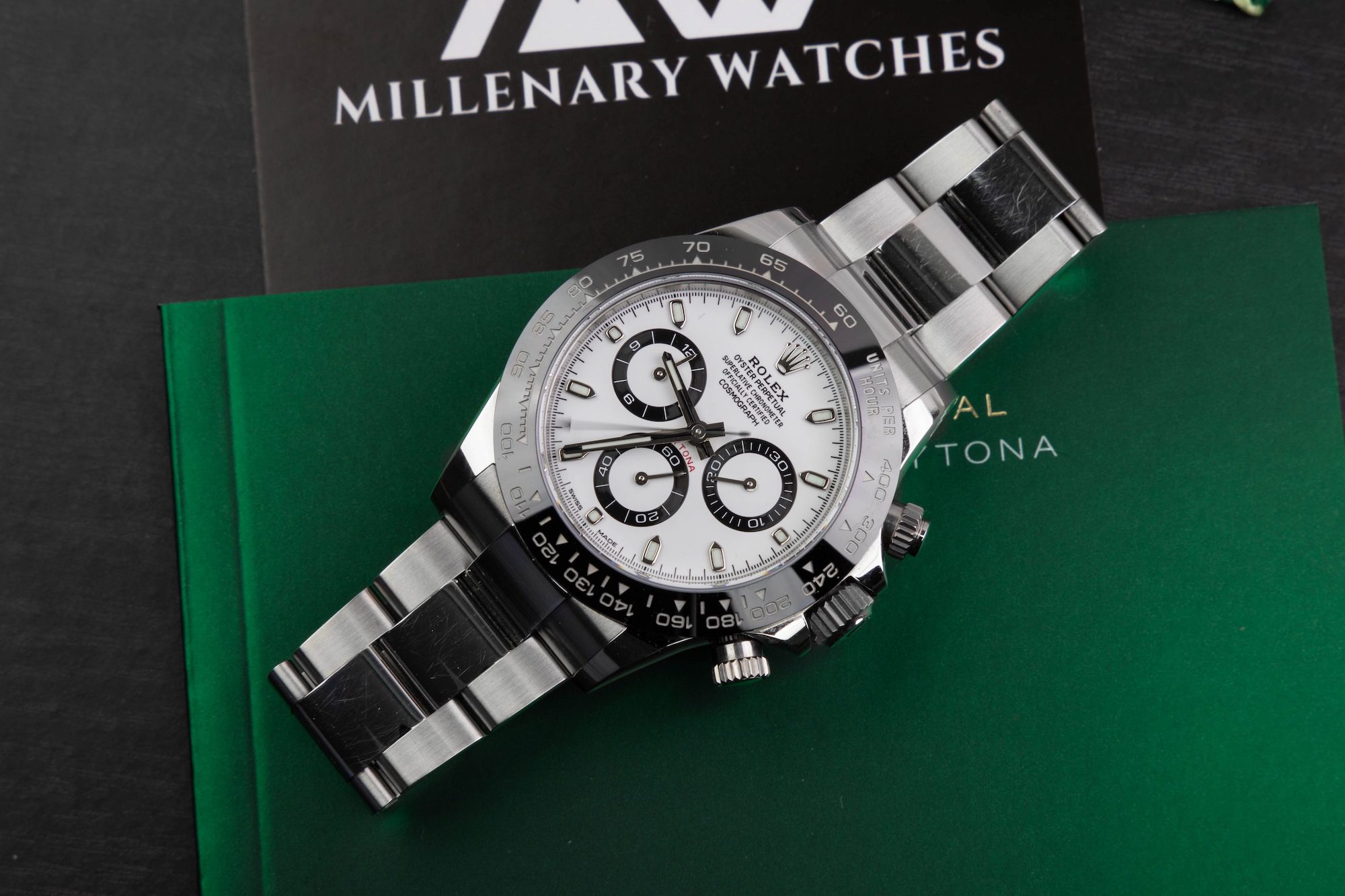

At the same time, Rolex doesn’t, at least not to a great enough point, adjust its retail prices due to market fluctuations according to the secondhand value of its watches. For example, Rolex would reasonably increase the price for the stainless steel Daytona by at least 100% overnight to make the retail price more balanced with the price on the secondhand market, but they don’t. At the beginning of 2022, Rolex prices for certain models started to decrease on the secondhand market, some more than others due to market uncertainty driven by increased interest rates and a number of other factors. If Rolex would have increased its list prices to match that of the secondhand market, it would have to reduce its list prices when the prices drop, and that is something that Rolex wants to do.

Instead of adjusting its retail prices according to the secondhand market, they predominantly take other factors into consideration, even though they certainly also look at the prices on the secondhand market.

Ultimately, the short answer to why Rolex prices on the secondhand market increase are that the demand for them is high, and continues to grow. And when the demand grows, the prices increase. These are basic market principles. But there are also other factors that come into play here and affect how much the price of a certain Rolex watch increases.

Discontinued models

Discontinued Rolex models have a history of increasing more in value than in-production watches do. The reason for this is that there will be no more watches made of this model. When a model is discontinued, the watches that exist are the watches that exist. As such, they will only become rarer and rarer over time. And if you, in turn, add the increased popularity of a certain model, it’s easy to see why the price would continue to increase further.

Rolex recommended retail price increase

In general, Rolex increases the recommended retail prices once a year. Sometimes, they increase less than that, and sometimes, they increase more. In general, Rolex increases its prices by roughly 2-7 percent per year. Usually, they increase the prices by an equal amount of percent for all models across the board, but in some cases, Rolex increases different models by more than others. In 2021, Rolex increased the price for its stainless steel models considerably more than its gold models.

The reason for this was the huge discrepancy between the retail price and the secondhand market, so this is an example of how Rolex factors in the secondhand price for its watches to some extent. At the same time, the price increase still meant that the retail prices for its stainless steel models were considerably lower than that on the secondhand market. In practice, this means that the price increase had no effect on the demand for these watches from the secondhand market.

When it comes to price increases, it’s always a balance of how much the market can take. If the price is increased dramatically, it all ultimately means that the demand will decrease. But because the prices for these watches on the secondhand market are considerably higher than the retail price, had no effect on the demand of them from official Rolex retailers, which is all Rolex cares about.

But Rolex hasn’t always been in the position it is in today. For most of its history, Rolex watches sold for less than the recommended retail price on the secondhand market. And frankly, this is the more normal thing when it comes to pre-owned items. You expect a car to go down in value the minute you buy it, so why wouldn’t the same principle apply to watches? The truth is, for most watch brands, that is exactly the case. But due to Rolex’s strong position and the fact that the demand is higher than the supply, it has gone the other way instead which is a desirable position for a company to be in.

The primary reasons why Rolex increases its list prices are the following:

- Inflation

- Increased costs (for example increased material costs, increased shipping costs, or increased labor costs). This ties into inflation but in some cases, it relates to increased costs for specific things and materials and not increased costs across the board which means it isn’t classified as inflation. For example, due to issues in the supply chain, the price of gold or steel may increase. And Rolex needs to adjust its prices accordingly to compensate for the increased cost of production

- Currency corrections. Since Rolex is a global company, they and their partners use different currencies. As such, they need to adjust their prices if some currencies are dramatically weakened.

The two key points at the top are the most important factors for Rolex price increases when it comes to the recommended retail price. These are also the key reasons why stocks are considered amongst the best ways to save your money from inflation. When companies adjust their prices to compensate for increased costs, it’s a hedge against inflation for stock owners. This is true for all companies, even though Rolex is not a publicly-traded company.

Rolex is not alone in increasing its retail prices on a regular basis. In fact, most luxury watch brands increase their prices around once a year or every other year. This includes brands like Omega, Patek Philippe, Audemars Piguet, and many more.

A general trend has historically been that when Rolex increases its retail prices, the prices on the secondhand market also increase. However, because the discrepancy has been so great in the last couple of years, it’s more difficult to see the exact correlation between them.

Currency corrections

Elaborating a bit on currency corrections: since Rolex has retailers all around the world, they buy watches from Rolex in their local currency. For example, if the EUR is dramatically weakened against the Swiss franc (CHF) which is what Rolex uses, it will become more expensive for the retailers to buy watches from Rolex, which ultimately eats into their margins. To compensate for this, Rolex does occasionally make corrections for its retail prices in certain countries and in certain markets that use specific currencies to compensate their retailers and to maintain the margins they expect.

Rolex’s goal is to keep the retail prices exactly the same across the world but because of the volatility of currencies, there will always be some differences. Rolex cannot simply change the retail prices for its watches on a daily basis. But as a result of this, it can cause even greater discrepancies in the future. Let’s say that after the currency in a country goes down, it goes back up again, but after Rolex made a currency correction. They don’t want to decrease its prices so the price in that country will simply be higher for some time until Rolex can make another adjustment, for example by increasing the price less in that particular country the next time a price increase takes place.

Rolex price increases

The fact that Rolex consistently increases its prices over the years is a great thing for Rolex owners because it provides a more certain guarantee that their watches will continue to increase in value. Whilst it is no guarantee that the secondhand market will follow as the list prices increase, that has been the case for Rolex watches as the company isn’t flooding the market with them. You could say that Rolex produces slightly fewer watches than the market would actually need, and for some models, considerably less. This helps them retain their exclusivity and value.

Only increasing the retail price is no guarantee for increased value

Whilst there is some level of correlation between increased retail prices and increased prices on the secondhand market, it’s not a fact. And there are plenty of examples of this. Most watch brands sell for less than the recommended retail price on the secondhand market, and if the retail price goes up, the discount for one could simply be greater. But Rolex’s strategy of not flooding the market with watches, combined with the prestige and strong reputation of Rolex, keeps the prices of Rolex watches on the secondhand market high.