Luxury Watch Prices Dropping – Everything you Need to Know

Starting from around February and March of 2022, we started to see declines, to even faster drops in the prices of certain luxury watches on the secondhand market. And it’s important to say certain because the majority of watches on the secondhand market remain virtually unaffected or have dropped only minimally, whilst other models have dropped more substantial amounts.

So why are luxury watch prices dropping? And how much are the prices of luxury watches dropping? Let’s get to the bottom of everything you need to know.

Some luxury watch brands have dropped in value more than others

Some luxury watches dropped as much as 15-30% of their value from the peak, which in hindsight can be said was right around January-February of 2022. This is when the watch market was soaring and the prices for the most sought-after luxury watches continued to increase in value, often by substantial amounts week-after-week, and had done so for at least the last 6 months, albeit with more reasonable price increases prior to this.

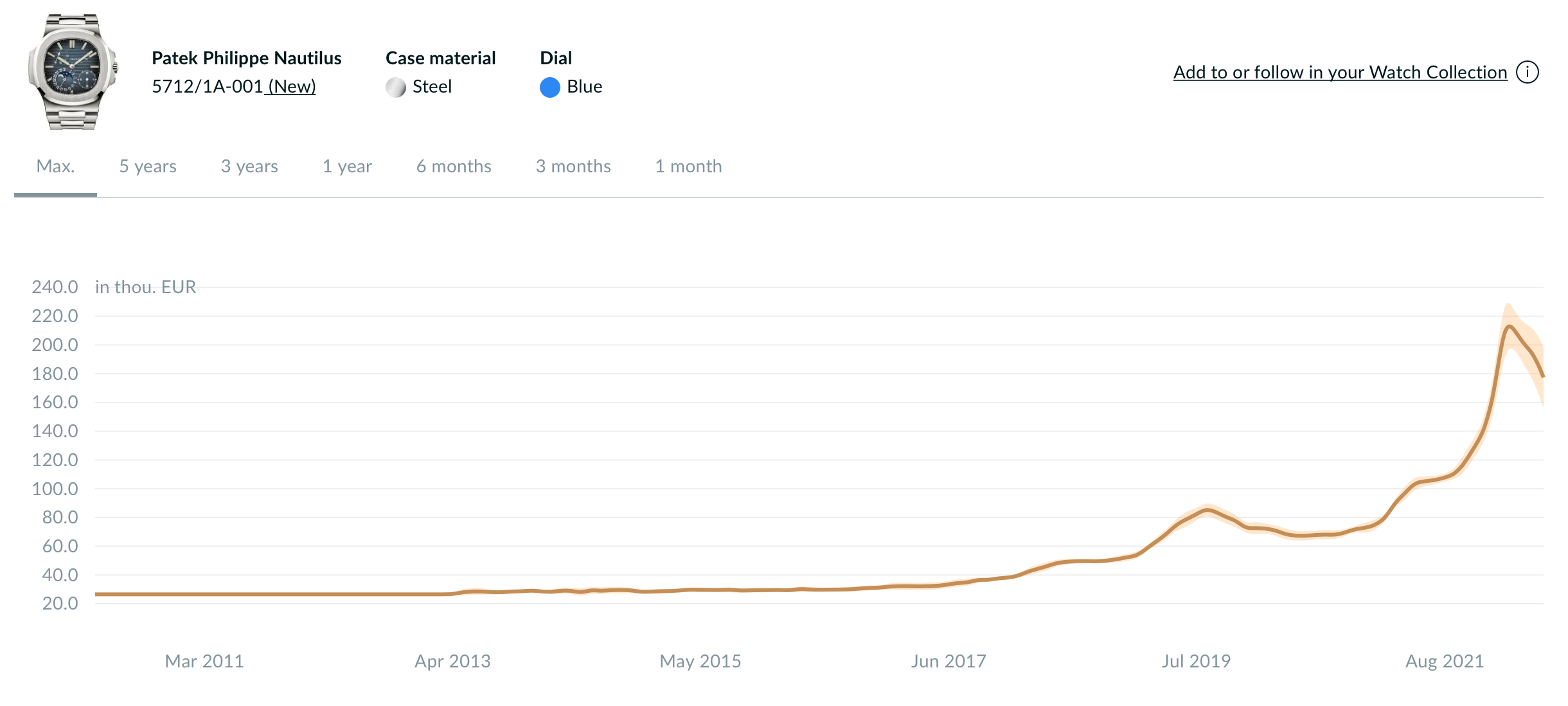

It’s important to have a broader perspective than just a few months when we talk about assets and their values. Luxury watches, in general, were increasing more than they had ever done before in an unreasonably short period of time. This of course cannot be said for all watches but in particular from the most sought-after brands, and specifically the most sought-after models. But to some extent, the “hype” was contagious and affected the prices of other brands and models as well, although to different extents. The brands that increased the most in value were Patek Philippe, Audemars Piguet, Rolex, and Vacheron Constantin, followed by other brands such as F.P. Journe, Richard Mille, Cartier, and others.

Why are luxury watch prices dropping?

Naturally, there are many factors that ultimately led to the price of some luxury watches losing much of their value, some more than others.

A common saying is that Everything that goes up must come down, and although luxury watches are viewed as some of the most stable and safest investments there are, they are not immune to declines. At the same time, declines in the value of luxury watches have been rare in the last couple of years. From a broader perspective, it seems as if luxury watches can only go up in price. But of course, anyone who understands fundamental economic theories knows that cannot be true.

Global factors also affect the watch market

The watch market is certainly not immune to external market factors. The watch market is, like all other markets, affected by the financial market and its state.

Ultimately, the global economy will always affect consumer goods. This is particularly true for goods that are non-necessities such as jewelry and watches. And entering 2022, the bull market is considered to be coming to an end and we are now moving into a bear market. Furthermore, a number of economic decisions and events that affect the global economy take place, and are planned to take place moving forward. One of the most critical components of this is naturally the interest rates that are planned by the Federal Reserve as well as most central banks around the world.

Economic fear of a recession

The most important cause for the watch market decline ultimately has to do with fear. Everything is pointing towards the fact that we are moving towards an economic downturn. Some suggest a recession, but only time will tell. With that said, we have an uncertain future ahead. And every time this happens, people tend to become more reserved and careful with their spending. They tend to delay big financial decisions and think twice before they make a high-value purchase, like a luxury watch.

When enough people think this way, it will ultimately lead to fewer customers. And according to the basic market principles, when the demand decreases, so must the prices. Prior to the watch price drop, the demand was surging and people were buying watches left to right. The demand and willingness to buy watches still exist, but more and more people ultimately delay their purchases to see if the prices will decrease further, or just wait and see what happens to the economy as a whole.

Inflation

Inflation is a big deal and has been a hot topic at the end of 2021 and the beginning of 2021. Inflation remains high during the first and second quarters of 2022 and when inflation is high, it negatively affects people’s ability to consume. Every day items become more expensive and people get less money left after all necessary expenses have been taken care of such as food, housing, etc. When inflation increases, all of these basic necessities become more expensive and therefore, people have less money to spend on things they want but do not necessarily need, like watches or other luxury items.

Unstable economy

An uncertain future is a great threat to the economy. The stock market is often looked at in terms of fear vs greed, and it’s safe to say that in 2022, we are in a fear-driven economy. As discussed earlier, this tends to make people more careful and reserved in regard to their spending. And therefore, people will often delay big financial decisions like buying a house or, in this case, an expensive luxury watch.

The war in Ukraine

The war in Ukraine is another driving factor that increases uncertainty and contributes to a more unstable economy and world. And ultimately, this spills over to the watch industry.

The fact is that the war is not only tied to Ukraine or Russia. It is affecting everyone globally to a smaller or larger extent. In Europe, households see rising costs of gas and food as a result of the halted gas export from Russia as well as the difficulty of exporting grain from Ukraine.

Moreover, with increased tension in the world also comes a greater uncertainty which negatively affects the global economy.

Watch market price drop summarized

Summarized, we can say that there are numerous factors that come together to make the watch market prices decline. Not only for watches but for many other industries as well, including the housing market. These factors can be summarized with:

- Increased Covid-19 Restrictions and lockdowns in China (Asia is a huge market for luxury watch sales, including the secondhand market)

- Rising inflation

- Increased interest rates and planned future interest rates

- The war in Ukraine

- Uncertainty in the global economy

- Big declines in the stock market (goes hand-in-hand with the watch market) but ultimately, it will make people feel “poorer” and thus consume less

- Fear of recession

The market will (almost) always correct unreasonable price increases

Looking at it from a broader perspective, the watch market can be compared with the stock market.

Following the stock market “crash” after Covid-19, the stock market quickly rose and shot through the roof. At times, it seemed as if the stock market could promise eternal growth. But at the end of 2021 and beginning of 2022, things started to turn the other way and we saw rapid declines in the stock market, naturally affected by numerous factors. Two of which were increased interest rates as well as growing inflation.

Anyone will be able to draw the conclusion that the rapid, almost skyrocketing prices of watches, as we saw in 2021 are not sustainable. If the watches would continue with the same trend of rapid growth, we would see essentially doubled prices of already high prices in 2023. But eventually, after such rapid value increases, there just aren’t any buyers left.

Now, only the market can decide what is “unreasonable” and what is “reasonable”. But what we can say is that the rapid price increase on watches in 2021 and the beginning of 2022 has not been reasonable. Therefore, all assets and items that increase that much and that rapidly have a great risk of eventually going down in value. And that is exactly what has now happened.

Are watches still great investments?

Yes, we would definitely say so. The “issue” is that the watch market has not had a major dip for a long time, which has caused people to believe that luxury watches can never go down in value. But like all assets, they certainly can, which has been proven following the 2022 decrease in watch prices.

But investments need to be looked at from a longer perspective than just one or two years. The stock market, in comparison, has its ups and downs, but if you look at it from a 10 or even 20-year perspective, the trend is still upwards. The same can be said about the luxury watch market. If you draw a straight line in watch prices and ignore the lows and highs, you’ll get a more reasonable trend of how the value trend for luxury watches should be in a sound and stable market. In other words, stable, reasonable, and consistent value increases without any dramatic spikes. The exact same is applicable to the stock market.

The price drop of luxury watches has not affected all watches equally

The watches that have seen the largest declines in value are the watches that have also increased the most from after the Covid-crash up until the watch market crash. Interestingly, a similar parallel can be drawn to the stock market. Those stocks that have gone up the most in the shortest time also tend to be the ones that fall the most. After all, they have the most drop height. Moreover, when some stocks tend to sore without any real news or positive financial reports, their valuation goes from logical to purely emotional, to fear of missing out, and speculation. When you go from a logical and financial valuation to speculation, that’s also when it can get dangerous quickly.

Because the major dips in the values of luxury watches can only be attributed to (relatively speaking) just a few models, it would be incorrect to call it a crash. Using the term “correct” or “dip” would therefore be better suitable.

As mentioned, the most dramatic price drops in luxury watches have happened to the most “hyped” watches with the most “inflated” prices. Or at the very least, for the watches that have increased dramatically in price in the year prior to the “dip”. The watches that dropped the most are:

- Audemars Piguet Royal Oaks

- Patek Philippe Nautilus

- Patek Philippe Aquanaut

- Rolex Daytona

- Rolex Day-Date

- Rolex GMT-Master II (in particular in gold)

Generally speaking, the price drop has affected modern watches much more than it has vintage ones. When we are talking about watches that are still in production, that makes sense. Ultimately, there will be more and more of these watches as the production continues. But for vintage watches, there will never be more of these watches made. As such, they will only get rarer and rarer. On the same token, vintage watches have, in general, not increased as much in value as more modern timepieces, although there are some exceptions.

And it’s also important to distinguish between price increases and skyrocketing price increases because it’s obviously more sustainable in the long-term for minor, stable value increases than rapid skyrocketing prices.

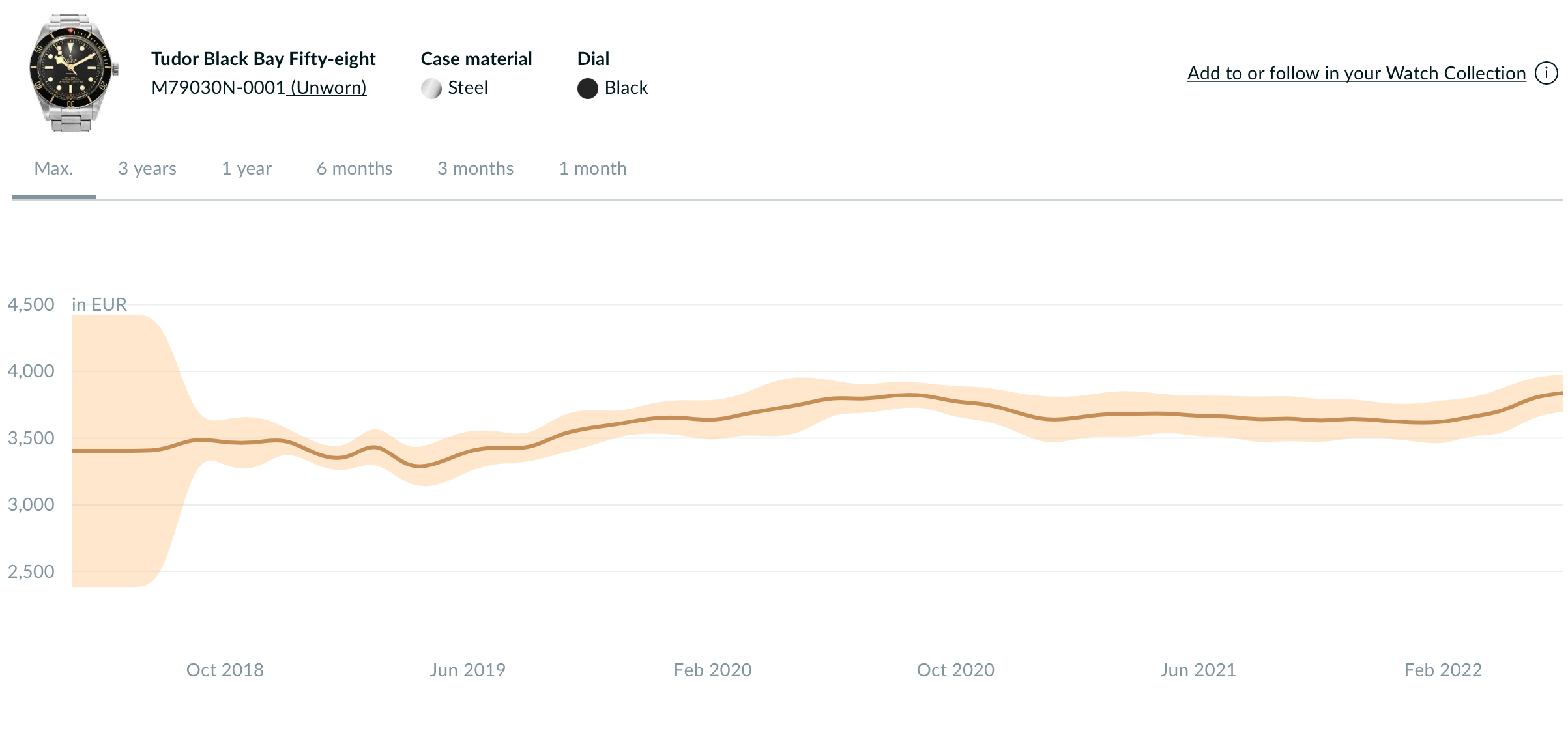

For some perspective, let’s look at a few models that didn’t increase in value a lot during the craziest price increases, and their prices after the “crash”.

The Tudor Black Bay 58 79030 is a good example of this. Prior to the most dramatic price increases in 2021, the Tudor 58 was selling for around retail price (usually slightly more, but not substantial). In 2022, after the most dramatic decline in price, the watch was selling for essentially the same as it did in 2020 and in 2021. In other words, because the watch didn’t really have a “hype” premium” or a dramatic price increase, the market deemed its price correct. As a result, its value did not crash.

The same can, as a matter of fact, be said about most luxury watches on the market where this is applicable.

These watches are all selling for roughly the same as they were prior to the drop in price. In other words, they’re essentially unaffected. Now, that doesn’t mean that it is impossible that they will decrease in the future, but it means that they are more resistant to rapid price decreases than those whose prices are driven to a large extent by hype and speculation.

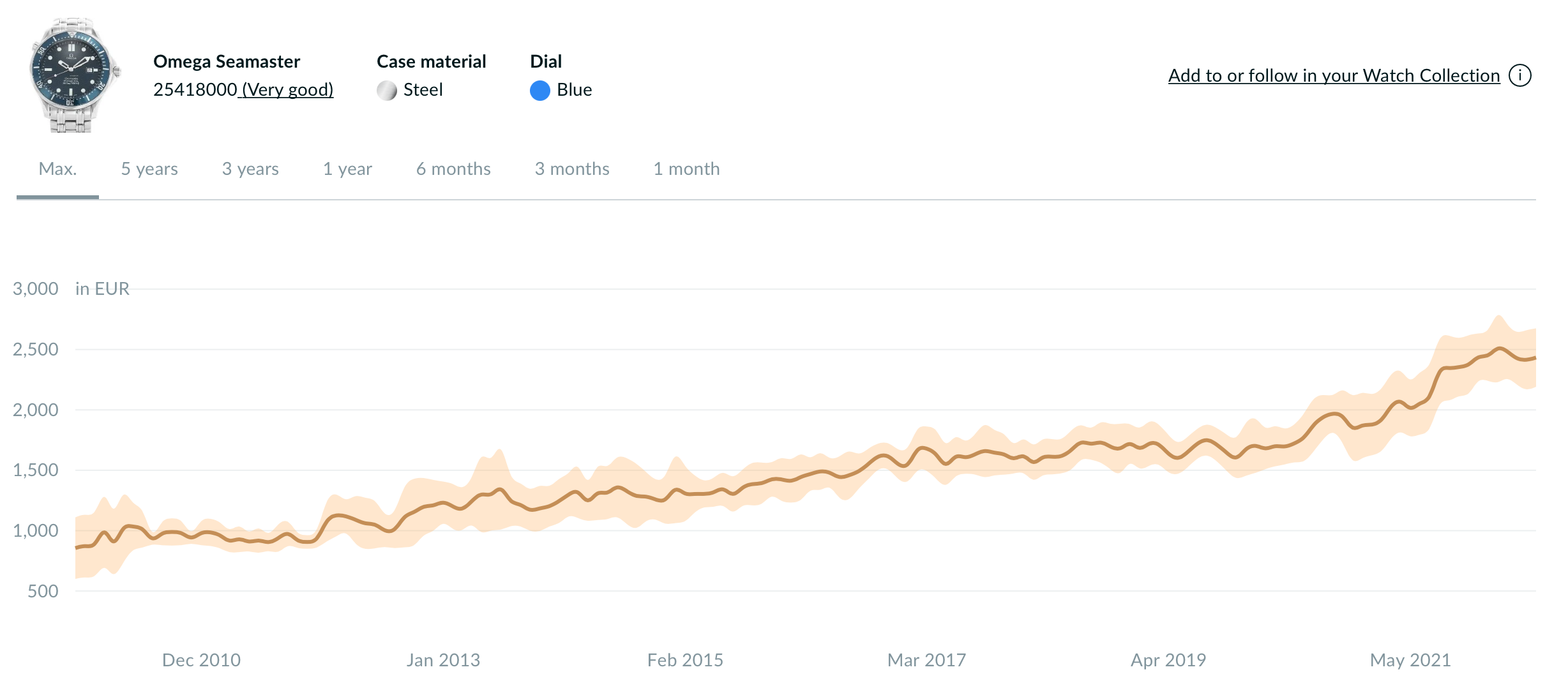

In addition, not all watches have declined in value. Some watches have actually increased in value during this time, such as the Rolex Oyster Perpetual 124300 coral red, yellow, or “tiffany” following the announcement that they were discontinued in April. As such, some have increased in value, some have decreased slightly or dramatically, but most have actually remained essentially the same.

The Audemars Patek Philippe Nautilus 5712 is one of the most sought-after Patek Philippe watches that the brand makes. It is also one of the watches that has been most affected by the price decline, as you can see in the graph below. From its peak at around €216.000 in February, it went to €176.900 in June which is a rather quite rapid decline in value of almost 20%.

A similar trend can be seen in another of the most hyped watches, the Rolex Platinum Daytona 116506. This is another watch that also saw a rapid decline in value following February 2021. The price for a non-baguette dial version went from around €204.000 at its peak in March to €117.500 in June 2022, representing roughly a 42% decline!

For some perspective, we can take a look at a less hyped watch, the Tudor 58 79030N, as discussed earlier. As you can see in this graph, this watch is virtually unaffected by the price decline of the most hyped watches. And the reason can only be attributed to the fact that it never had a rapid price increase and did not have “hype” that inflated its price:

Another example is the classic Omega Seamaster James Bond watch which is also unaffected by the price drop, as seen in the graph below.

Another example is the classic Omega Seamaster James Bond watch which is also unaffected by the price drop, as seen in the graph below.

The bottom line is that it is crucial to understand that the price drop has primarily affected the most hyped watches that have increased the most in value during 2020 and 2021. And the watches that have increased the most during this time seem to be the watches that have taken the biggest hit (surprise!). Different watches have been affected differently. Some have dropped in value as much as 30 or in some cases, even 40%, whilst others have only been affected marginally, if at all.

Has the luxury watch market crashed completely?

No, absolutely not. The luxury watch market is stronger than ever and the demand is continuing to be extremely high. All the sought-after models still have year-long waiting lists from the official retailers and still command great premiums on the secondhand market. Yes, the demand for luxury watches will decrease in the case of an economic downturn, but the demand is still far greater than the supply for the most sought-after watches and that will be the case for a long time ahead, recession or not.

With that said, the most hyped watches are still selling at a hefty premium over the retail price, even after the price decline. And most likely, they will also continue to do so for a long time due to their scarce availability.

And as mentioned, the value decreases we have seen on some luxury watches apply to only a small portion of all the models and watch brands within the luxury watch market. As discussed, the watches that haven’t increased dramatically in price have not decreased anything, or only by very little in price.

And these watches stand for the majority of all the watches in the luxury watch market. So when people scream in fear and say that the watch market has completely crashed, it is just not true.

Looking at the watch price decline from a larger perspective

At most, some watches have declined 15 to 30% in value after the price decline. On some occasions, the values have decreased by 35-40%.

And yes, that is a lot for any price decline, be it stocks or watches. But if we zoom out and have some perspective, we can conclude that the watches that have dropped the most in value are essentially back where they were 6-12 months ago. Yes, if you bought a watch at the very peak, it can feel frustrating to know that your watch is now worth considerably less than you paid for it. But there’s nothing that says that it cannot go back to the value it once was. In fact, everything suggests that watches will continue to increase in value like they always have done historically. But the reasonable thing would be if they increase at a slower, less dramatic pace as they did in 2021 and the beginning of 2022.

If you see it from this perspective that only about 6 months of price increases have been wiped out for some models, it doesn’t sound that serious at all. And that is because it is not. The luxury watches are still up in value considerably if we look at it from a 12-month perspective. And from a financial and investment standpoint, 12 months is actually not that long at all. One could say that the decline is just a correction of a previously unsustainable price increase. It’s just that few people complain about it when something goes up in value. More people complain about it when they go down in value and they lose money.

The only watch I desire is the very rare AP Royal Oak with the salmon dial and leather strap from the 1990’s.

It’s beautiful and understated and amazing. Cannot find one.

That is indeed a very stunning watch!

Kind regards,

Millenary Watches