Best Rolex Watches for Investment: A Guide to Buying Rolex Watches for Investment

Rolex is unarguably the world’s most famous luxury watch brand. No matter if you’re in Russia, France, or the USA, people, even those who don’t know watches very well, often know about Rolex.

Its history stretches far back to the end of the 19th century, and over the years, it has undergone huge changes, come up with revolutionary innovations, and had a huge impact on the luxury watch industry.

Rolex is one of the older watch brands in the world and today, Rolex watches have become a symbol of success, prestige, reliability, and extreme quality.

It’s no secret that Rolex watches are expensive. While everything is relative, Rolex watches are among the most prestigious watch brands in the world, never compromising on quality, and being a luxury watch brand, the price of their products naturally reflects that.

But what is particularly interesting is that Rolex watches can actually be investments. In fact, the value of some Rolex watches has significantly increased in value, and if you buy the right Rolex watch, it can prove to be a great investment over time. And if you buy the right watch, you can wear it and enjoy it, and sell it for the same price that you bought it for.

But the value of Rolex watches is, like everything, decided based on supply and demand. Some Rolex watches have skyrocketed in value over the years more than others, and the reason for this is that the demand for them is extremely high, while the supply of them is rather “limited”.

This is also the reason why the Rolex watches that tend to increase most in value are watches that are now discontinued and have been made in limited numbers. It goes without saying that if there would be no demand for secondhand Rolex watches, they wouldn’t hold their value well, and they certainly wouldn’t increase in value. This is the case for many other watch brands, but not for Rolex. At least not right now, and it doesn’t look like the demand for Rolex watches is decreasing anytime soon thanks to Rolex’s strong brand and importance in the watch industry.

In this article, we share the top Rolex watches for investment purposes, go more into detail about what to think about when buying Rolex watches to make a good purchase, and give you our best tips on what to think about to buy Rolex watches that increase in value, and which prove to be great watches for investment. The best part is that while owning them, they can bring you lots of joy, and be enjoyed, and not just be locked up in a safe.

The controversy of Rolex investments

Now, we cannot hide the fact that there is some controversy regarding the topic of Rolex and investments. We will not discuss whether you should buy Rolex watches as investments, but the “controversial” thing about Rolex watches as investments are that some collectors argue that Rolex watches are meant to be enjoyed, and if you factor in the financial part of always looking to buy watches that will make good investments, you remove a bit of the charm of watch collecting, and you tend to focus more about the money than on the watches. Thinking about the best Rolex for investment means that you limit yourself in your collection, resulting in you perhaps not buying the watches that you truly want simply because they are not the best investments.

Do note that this is only us sharing two sides of Rolex for investment. And since we are always looking to help our customers out as much as possible, we want to give a thorough answer to a question that we receive quite frequently.

Quick tips for Rolex investments

- Think about supply and demand

- Think about future collectability

- Professional/sport watches are the most popular and safest bets

- Consider the type of metal- steel is naturally the most timeless and safe investment.

Think about supply and demand

Rolex, in general, is among the most popular luxury watch brands in the world. As a result, the demand for Rolex watches on the secondhand market is extremely high. But of course, not all Rolex watches are created equal, and therefore, not all watches hold their value equally well. As a result, not all Rolex watches can be considered ”investment pieces” if you’re hoping to own a Rolex watch that increases in value a lot over time. Rolex is among the best watch brands to buy if you want your watch to hold its value.

Of course, it is worth pointing out that just like with all investments, it is impossible to know whether or not a Rolex watch will actually increase in value over time. But the concept simplified is that over time, some Rolex watches can increase in demand for different reasons, and it is particularly when Rolex regularly increases its retail prices, and when the demand for models that are produced in limited quantities, often because of a limited production time, that the value tends to increase the most. As a result, this is something worth taking into consideration when looking for Rolex watches to buy for investment purposes.

The Rolex Datejust, for example, is one of Rolex’s most iconic and popular models, but because they were among the most produced Rolex watches back in the day, the supply of them is also high, and so, therefore, while the value of these watches has increased over time, the cost has not skyrocketed. This is why it is still possible to buy most vintage Rolex Datejust watches for well under 5000 euros. But while a Rolex Datejust certainly can be a good investment, it will most likely not be a Rolex watch that increases dramatically in value within the coming decades, and therefore, it cannot be considered an ideal Rolex model for investment purposes.

Vintage Timepieces

It is safe to say that vintage Rolex watches are the best timepieces to buy for investment purposes. The main reason for this is based on the supply and demand principle discussed earlier. Now, there are of course exceptions to this, but we are talking overall and over time.

Modern Rolex watches which are currently in production are just that – in production, and therefore, they’re currently not limited. When a Rolex model is discontinued, it naturally gets increasingly difficult to get a hold of the watch you are looking for as you have to look at different places than the authorized dealers. And while some models that are in production can be difficult to get even from an authorized dealer due to limited production or high demand (or both), they’re still possible to get from these sources, as opposed to discontinued models.

It is with vintage watches that big Rolex investments can be made because of all the factors mentioned earlier.

These are the key reasons and factors that affect the value increase and ”investability” of Rolex watches:

- High demand

- Low supply

- Limited production

- Rare models with subtle differences (for example the Rolex ”red Submariner” which is a standard Submariner but has the Submariner lettering printed in red instead of white.

- Important models for Rolex and history, for example, the ”Paul Newman Daytona”, which became popular among collectors after Paul Newman was seen wearing one, and thus also got greater historical importance.

Furthermore, another factor to take into consideration with vintage Rolex watches is the condition. As time passes, examples disappear, break, are thrown away (by people who don’t know what they are), and maybe most commonly, are worn and thus get signs of wear. When this happens, parts tend to be changed during repair, the watch gets worn condition, and most often, the case is polished.

All of these factors affect the value of vintage Rolex watches, as collectors are mainly looking for completely original vintage Rolex watches that are exactly the way they were when they were originally manufactured, with no parts exchanged.

But, as mentioned, because of wear and services, not only does the number of vintage Rolex tend to decrease over time, the number of fully original vintage Rolex watches in great condition tends to get increasingly difficult to come by.

Therefore, if you are going to buy a vintage Rolex watch for investment purposes, it is crucial that you buy fully original watches with all original parts as this tends to have a negative effect on the secondhand value of vintage Rolex watches.

In fact, the difference in value between a fully original Rolex watch and the same Rolex watch with exchanged parts, such as hands and bezel can be significant.

The reason for this is first off that the number of completely original vintage Rolex watches only decreases, but also because non-original parts can harm both the look and vintage feel of the watch.

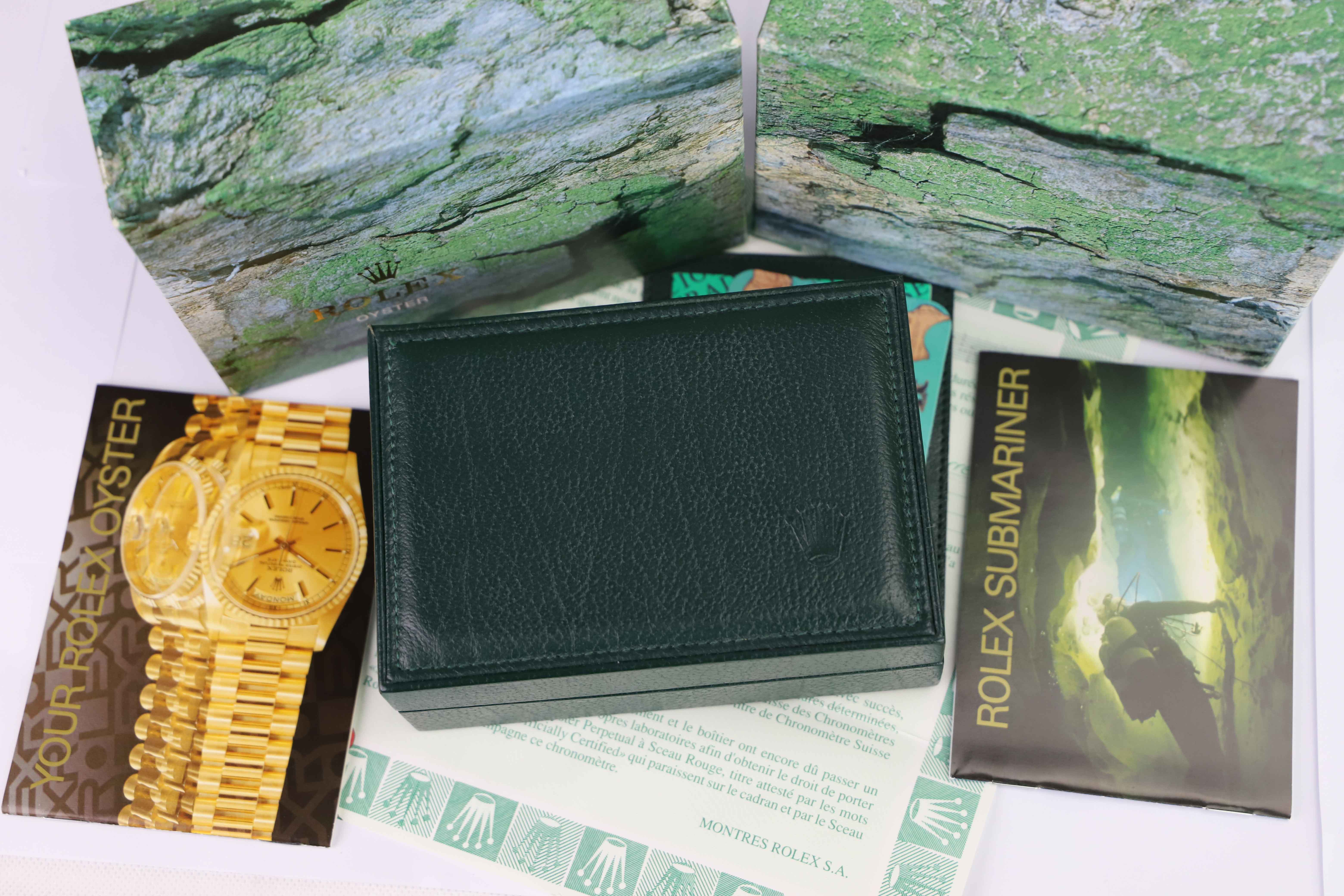

Furthermore, another factor that affects the secondhand value of vintage Rolex watches is the accessories that come with the watch when bought new. When you buy a Rolex watch, you get a box, certificate, and other papers, such as a user manual. Vintage Rolex watches also come with other accessories such as a cardholder and a hang tag.

These accessories tend to disappear to a larger degree than parts are being changed, for obvious reasons, and therefore, finding a vintage Rolex watch that is in its original state, including all its original accessories gets increasingly difficult the longer time passes from the time of the watch being discontinued.

This is why a completely original vintage Rolex watch with all its original accessories is the best watch for investment purposes as these are the hardest to come by. When talking about Rolex accessories, the more the merrier, and if you have all original accessories, in particular for watches that are becoming rare, and were produced in limited numbers, it can really have a huge impact on the watch’s value. Having this can increase your watch’s value by as much as 10, 20, or 30 percent. Maybe more, depending on the model.

Professional/Sport Watches

Professional sports watches from Rolex are the most popular and also the most historically important timepieces. As a result, vintage sport Rolex watches have proven to be the watches that are the best for investment purposes. It is these watches that have seen the biggest value increases.

What is interesting to point out, though, is that the market changes. Back in the day, the vast majority of people wore smaller, more elegant dress watches, such as the Rolex Oyster. This was because mainly professionals who needed sports watches as tools wore them when they really needed them. Today, sports watches have become extremely popular, which has also meant that the price of vintage dress watches is quite low today. The point is that the market changes, and while sports watches could, in theory, go out of fashion, it is very unlikely, but it just shows that trends and styles change over time, and this is something worth factoring in.

The most popular sports watches from Rolex are the Submariner, Daytona, Sea-Dweller, and GMT-Master (II). To some extent the Yacht-Master is as well, but this is far from as popular as the Submariner, for example. There are of course other Rolex sports watches that are popular such as the Sky-Dweller, but this model is still a ”modern” Rolex and has not existed long enough to become vintage, and has thus not lived long enough to see the vintage demand the other sports watches see.

The good news is that not only vintage Rolex sports watches can be investment pieces. In fact, modern Rolex sports watches which are still in production (or recently discontinued) can prove to be investments due to the high demand for them. And in this case, the best bet of watches with the highest probability of increasing in value over time is the sports models listed.

”While the Rolex Datejust and President are among some of the most iconic and recognizable watches in the world, it is Rolex’s sort watches that generally receive the most attention and the highest bids from serious collectors.”

Metals

With all of the things mentioned above in mind, another factor to consider is the metal type. Generally, steel watches are the Rolex watches that tend to increase the most in value. While some argue that if the demand for watches would completely disappear, you at least have the precious metal value left, however, that’s not something that the general market sees. At least right now.

The same thought could be applied to Rolex watches with gemstones, but the same thing goes here, where diamond Rolex watches don’t tend to hold their value very well. This could also be because most Rolex professional watches don’t have gemstones.

The fact that Rolex watches made of precious metals or featuring gemstones don’t tend to hold value as well as stainless steel watches is only tied to demand. The demand for precious metal Rolex watches is simply not as high as for steel watches.

So if you’re looking for the best Rolex watches for investment purposes, look towards stainless steel Rolex watches and have that as a rule of thumb, because the vast majority of them won’t skyrocket in value just because the market is not as big, and therefore, the demand isn’t as high. There are of course exceptions, but generally speaking.

Rolex Submariner

The Rolex Submariner is probably the safest bet when it comes to buying Rolex watches for investments.

The Submariner is Rolex’s most iconic and recognized watch, and it is also the Rolex watch that has proven to increase the most in value. The Submariner is sporty, robust, durable, and has a truly timeless design. The Submariner was first launched in the 1950s, but there are still clear similarities between the most modern iterations. This goes to show just how timeless the Submariner is. And therefore it is a great investment piece as the design will never go out of style.

Since the Rolex Submariner has been in production for well over 50 years, Rolex has made many different references and iterations of the Submariner. So while the model name is the same from the beginning to now, there are a large number of Submariner reference numbers, with large or subtle differences. Naturally, the demand for the different reference numbers varies depending on different reasons.

Some Submariner reference numbers are more popular than others and are thus more expensive, and more in demand. And in particular, for the vintage Rolex Submariner watches, the production numbers are limited, and the numbers that exist will only become smaller. Therefore, logically, the Rolex submariners will continue to increase in value over time.

If you decide that you want to buy a Rolex Submariner as an investment, make sure you carefully research the serial numbers so you know exactly which reference you want, and so you can then factor in the nature of each reference and decide which references will most likely be best from an investment standpoint.

Obviously, the Submariner references which have been produced in smaller numbers are generally more expensive than those that have had long production times, and as you move further back to the earlier Submariner models, the condition starts playing a more and more important role.

Today, it is not uncommon that some Submariner models sell for several hundred thousand, and factoring in that these watches cost a few hundred dollars originally (obviously have to adjust for inflation), it can be considered quite a profitable investment.

If you make the right purchases, modern Submariners can prove to be investments in the future, but right now, it’s difficult to know. For the vintage Rolex watches, on the other hand, you can simply look at how their value has increased over the years and then consider the likelihood of the value increasing further. For modern watches, you can’t do that in the same way. But if you look at the history, the Submariner has always increased its value above the retail price over time after the reference is discontinued. It may demand you to wait some decades, but the future will tell.

Rolex GMT-Master

The Rolex GMT-Master is a truly iconic Rolex watch, and behind the Submariner, it is one of their most popular watches.

There’s a great demand for the Rolex GMT-Master and the GMT-Master II, and the vintage GMT-Masters have been models that have particularly increased in value over time. The first Rolex GMT-Master reference 6542, for example, has increased significantly in value over the years, and can now sell for over a hundred thousand euros.

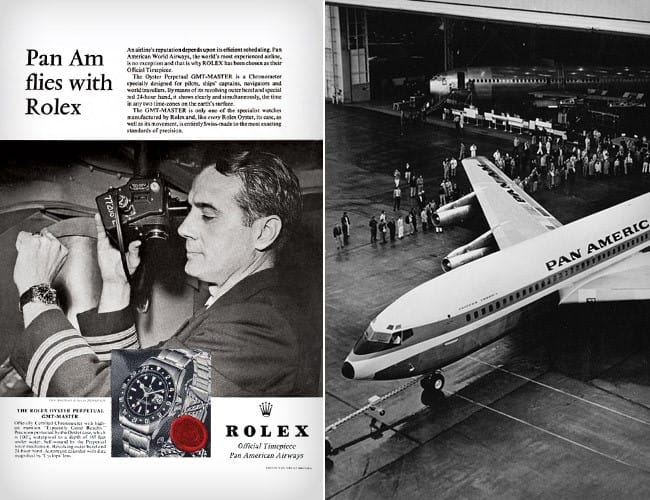

The Rolex GMT-Master is a watch that plays a very important role in Rolex’s history. The watch was made for Pan American airlines to help the pilots flying across time zones keep track of two time zones simultaneously.

At the time of its launch, the GMT-Master was a very technical feat, and it carved the way for other brands to follow.

Collectors and watch enthusiasts alike are obsessed with the GMT-Master (and the later GMT-Master II), and therefore, there has always been a demand for these models.

Just like with the Rolex Submariner, there have been numerous references to the GMT-Master, and today, some are more popular than others because of the different reasons discussed.

Therefore, a Rolex GMT-Master is one of the best Rolex watches to buy for investment, but at the same time, it is important that you carefully research the different references that exist because not all GMT-Masters are created equal.

Rolex Daytona

When talking about the best Rolex watches for investment, we cannot forget the Rolex Daytona.

The Rolex Daytona is one of the most iconic and important Rolex watches, and the world’s most expensive watch ever sold (which happens to be a Rolex in writing moment) is the Rolex Daytona ”Paul Newman”, which was owned by Paul Newman himself. This watch sold at auction for a whopping $17.75 million.

Talk about a great investment.

The Rolex Daytona is a popular watch among collectors, in particular, the vintage Rolex Daytona watches, and just like the Submariner and GMT-Master, the Daytona has many different reference numbers, which, again, have different demands.

The Daytona was first launched in 1963, the Rolex Cosmograph Daytona, and was inspired by racecar drivers and enthusiasts. The value of the Rolex Daytona

Conclusion

So, with all of these things in mind, which Rolex to buy for investment? What Rolex is the best investment?

The real answer is that it varies over time. For example, in writing moment, the 50 anniversary Rolex Submariner ref 16610LV has skyrocketed in price over the years. Today, we’re looking at a price of between 10k and 20K euros. Only a few years ago, the Kermit could easily be bought for around 4K to 6K euros. Talk about a solid increase.

But things like these are generally quite hard to predict, and so when talking about the best Rolex investment, the way the market looks today, and with past events factored in, the sports Rolex watches in steel will almost with certainty continue to climb in value.

Disclaimer

This article is not meant to tell you exactly what you should do when you want to buy a Rolex as an investment. This article only shares the basic principles of Rolex watches, and what can affect how the value of Rolex watches will evolve over time. Do not see it as a clear-cut guide for how you buy Rolex watches as investments.

Just like with any investment, it is impossible to know whether it is a great deal or not until the future tells us.

The article leaves no guarantees on whether the watches mentioned will actually increase in value and prove to be great investments, instead, it is based on how the value of Rolex watches has evolved when looking back.

More tips on buying Rolex watches as investments

Want some more advice and information on buying Rolex watches as investments? Check out the guides below:

Do you have any additional specific questions regarding Rolex watches for investment? Consult one of our watch experts here!

This is really useful, thanks.

Great article! This is the kind of information that are meant to be shared across the net.

Disgrace on the seek engines for now not positioning

this put up upper!

Thank you =)

Thanks very interesting.

My son is looking to invest in a submariner.

I have a submariner,no box or papers model 5513 have they appreciated much in price since 70’s

Glad you found our article interesting.

Yes, the prices of Submariner 5513s have skyrocketed since the 1970s. Congratulations on a lovely timepiece!

Regards,

Millenary Watches

Love my submariner with blue face and gold links. Seem to get a lot of attention.

I have placed order for the sub HULK as it is very distinct and eye catching.

But the deep sea dweller is also awesome.

I want one of each 🙂

Thank you for sharing! The blue Submariner is stunning!

Thanks for sharing! I find that the Yacht Master Steel with Platinum brezel very under valued. What is your view?

Thank you for your comment.

Yes, we agree, but in the recent years, it has picked up in popularity as the availability of other models such as the Submariner and GMT is difficult to get a hold of. It will likely get the recognition it deserves in the coming years.

Kind regards,

Millenary Watches

Hi there. Love the article, very informative. As you did mention the DateJust being a good investment, the next paragraph said not so much with diamonds or gemstones. Little confused as I have the 41 Oyster Perpetual Mother of Pearl with diamonds as the hr Markers. Ither way I love this watch, it took me a long time to settle on this watch. I’d probably sell everything else before that watch. What’s your take on it as an investment? Thank you for your time. Steve.

Hi Steven,

The Datejust is a classic, but generally speaking (except for watches produced in limited numbers), the more niche a watch is, the less of an investment it will be. Since diamond watches are not for everyone, there will be a smaller audience of potential customers. It can still prove to be an investment but likely less than one without diamonds.

Kind regards,

Millenary Watches

You have not discussed the yacht master , I have a gold one which I love. Will they increase in value over the years?

Hi Jake,

Thank you for your comment. The future will tell. Generally, the Yacht-Master is not as popular as other Rolex sports watches discussed in this post, but overall, most Rolex sports watches have proven to increase in value over time.

Kind regards,

Millenary Watches

YM is terribly not popular, I change into sub 1680 for better looks and investment.

What about Datejust 41 Wimbledon Rose Gold Two-Tone Jubilee / Oyster watch ? Would you suggest that both watches is a good investment ?

The Wimbledon dial is very popular. At the same time, as stated in the article, gold watches tend to be less popular than the full steel counterparts.

Kind regards,

Millenary Watches

Your article is spot-on correct. I do have a few questions…1) I have a mint 1951 Rolex Bubble Back. How do they hold up in value? 2) I have a Rolex Daytona with Zenith movement, I just sent it to Rolex for complete clean-up/ Is this a valued watch? I have a Pres, with diamond dial and bezel, a later model, and also a ladies pres, two years old, mother of pearl face, diamond dial and diamond bezel, all by Rolex, no aftermarket, box and papers, etc. Do these hold any value over time?

I love this article! Thanks.

I am considering a Rolex Submariner Date 18k Gold Steel Ceramic Diamond Dial (116613). I think the price point is right but am comparing this vs the Kermit (similar price point).

I felt that the Kermit is overpriced now given the hype and the 116613 have a lot more upside in terms of value.

And it’s a newer watch.

What are your thoughts?

Hi Eric,

The kermit is and always will be a collector’s watch. With that said, it will likely continue to increase in value.

The 116613 is not at the moment, so it’s difficult to predict the future. What we can say is that the 16613 is not as unique and special as the 16610lv as it is not an anniversary timepiece.

Kind regards,

MW